Subrogation in Alabama Workers’ Compensation Cases: Not Too Shabby

By: Amanda Goozée & David Lindsey

Under Alabama law, employers have the right to reimbursement or subrogation for benefits paid under the Workers’ Compensation Act (the Act), including vocational, medical and compensation benefits. See Ala. Code § 25-5-11. This right applies when an employee’s injury or death, compensable under the Act, is also caused by a third party who may be legally liable for damages.

Reimbursement and Subrogation Rights

When an injured employee or his dependents recover damages from a third party, the amount collected is credited against the employer’s liability for compensation. If the damages exceed the compensation owed, the employer has no further liability. Additionally, the employer is entitled to reimbursement for benefits already paid, including medical and vocational expenses. The employer’s subrogation rights can also extend to future medical and vocational benefits. See Ex parte BE & K Constr. Co., 728 So. 2d 621, 622 (Ala. 1998); See also Ex parte Williams, 895 So. 2d 924, 928-29 (Ala. 2004).

Distinction Between Compensation and Medical/Vocational Benefits

Alabama law distinguishes between compensation benefits and medical/vocational benefits. “Compensation” typically includes payments related to temporary total, temporary partial, permanent partial or permanent total disability. See Ala. Code § 25-5-1(1) (1975). These compensation rights are statutory and not subject to “equitable subrogation,” which means the employer directly steps into the employee’s shoes to pursue reimbursement. See Maryland Cas. Co. v. Tiffin, 537 So. 2d 469 (Ala. 1988).

However, the right to subrogation for medical and vocational benefits is subject to equitable subrogation laws, meaning the employer’s right to reimbursement can be limited based on fairness principles. See Trott v. Brinks, 972 So. 2d 81, 87 (Ala. 2007). Additionally, employers do not have subrogation rights regarding damages recovered from wrongful death suits or from uninsured or underinsured motorist benefits. See Bunkley v. Bunkley Air Conditioning, Inc., 688 So. 2d 827 (Ala. Civ. App. 1996).

No Notice Requirement

Unlike most jurisdictions, Alabama does not require employees or third parties to notify employers about potential third-party lawsuits or settlements. This lack of notice requirement means employers are often unaware of actions taken by employees to recover damages from third parties. See Ex parte Lewis, 667 So. 2d 104 (Ala. 1995). Furthermore, third parties are not obligated to protect the employer’s or insurer’s subrogation rights, and employers cannot sue a third party for reimbursement after a settlement. See Ala. Code § 25-5-11(a); See also Automotive Wholesalers of Alabama v. Kruetzer, 796 So. 2d 1110 (Ala. Civ. App. 2000) (citing Orum v. Employers Cas. Co., 348 So. 2d 792, 795-96 (Ala. Civ. App. 1977)).

Right to Intervene

Employers generally do not have an automatic right to intervene in third-party lawsuits, except in subrogation cases involving death benefits. In subrogation cases involving death benefits, courts may allow conditional intervention to protect the employer’s reimbursement rights. See Millers Mut. Ins. Assoc. v. Young, 601 So. 2d 962 (Ala. 1992). On balance, an employer or workers’ compensation insurer may want to file a petition to intervene in a pending third-party lawsuit to ensure all parties (and the court) are aware of an employer’s/insurer’s subrogation lien and to promote efficiency.

Attorney’s Fees and the Fitch Formula

When a third-party recovery occurs, employers must contribute a proportionate share of the attorney’s fees and expenses, reflecting the benefit they receive from reduced liability in the workers’ compensation claim. See Ala. Code § 25-5-11(e). The calculation of this share follows the “Fitch formula” established in Fitch v. Ins. Co. of North America, 408 So. 2d 1017 (Ala. Civ. App. 1981).

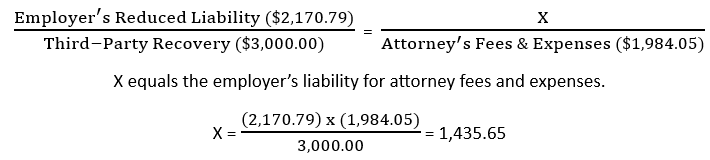

In Fitch, an employee received $3,000.00 from a third-party lawsuit while the employer’s insurer, INA, had paid $2,170.79 in benefits. Attorney’s fees and expenses amounted to $1,984.05. The court calculated the employer’s liability for fees and expenses as follows:

X = $1,435.65 (This represents the employer’s liability for attorney fees and expenses.)

After deducting this amount from the reduced liability ($2,170.79 - $1,435.65 = $735.14.), the employer’s final credit was $735.14. The Fitch formula essentially requires the employer to pay one-third of the recovered amount and one-third of the liability reduction as its share of attorney’s fees. See Maryland Cas. Co. v. Tiffin, 537 So. 2d 469 (Ala. 1988).

Conclusion

The Alabama Workers’ Compensation Act provides clear guidelines on employer subrogation and reimbursement rights. Employers can recover compensation paid from third-party settlements, but they must share in the legal costs associated with obtaining those recoveries. Understanding the distinction between compensation and medical/vocational benefits, as well as the nuances of the Fitch formula, is crucial for employers navigating third-party recovery situations.

Attorney Contact Info

Amanda Goozeé

amanda.goozee@swiftcurrie.com

205.314.2402

David Lindsey

david.lindsey@swiftcurrie.com

205.314.3063